What Is a 1031 Exchange!? Save On Taxes.

How Expert Investors Utilize 1031 Exchanges to Delay Capital Gains and Accumulate Wealth.

What Is a 1031 Exchange!? Save On Taxes.

A 1031 exchange refers to the act of exchanging one investment property for another, enabling the deferral of capital gains taxes. The name originates from Section 1031 of the Internal Revenue Code (IRC), and the term is frequently used by real estate professionals, investors, and others. Some even turn it into a verb, for example, “Let’s 1031 that building for another.”

There are various aspects of IRC Section 1031 that real estate investors need to comprehend before attempting to utilize it. The exchange can only occur between like-kind properties, and the IRS imposes restrictions on its application to vacation properties. Additionally, there are tax consequences and time limits that may pose challenges.

For those considering a 1031 exchange or simply interested in learning more, it is crucial to familiarize oneself with the associated regulations.

Key Takeaways

-

- A 1031 exchange is a tax incentive that allows individuals to sell a property used for business or investment purposes and acquire a new property for a similar purpose, enabling the deferral of capital gains tax on the transaction.

-

- The sale proceeds must be held in escrow by a third party and subsequently utilized to purchase the new property without the seller receiving them, even momentarily.

-

- For capital gains taxes to be deferred, the properties involved in the exchange must be deemed as like-kind by the IRS.

-

- When properly executed, there is no restriction on the frequency of utilizing 1031 exchanges.

-

- The rules may also apply to a previous primary residence under certain specific circumstances.

What Is Section 1031?

In general terms, a 1031 exchange, also known as a like-kind exchange or Starker exchange, involves exchanging one investment property for another. While most swaps are taxable as sales, those that meet 1031 requirements may have no or limited tax liability at the time of the exchange.

This allows you to transform your investment without being seen as cashing out or realizing a capital gain by the IRS, enabling your investment to grow tax-deferred. There is no restriction on how often you can use a 1031 exchange. You can roll over gains from one real estate investment to another repeatedly. Even though you might make a profit on each swap, you can defer paying taxes until you eventually sell for cash, potentially resulting in just one tax payment at a long-term capital gains rate (15% or 20% depending on income, and 0% for some lower-income taxpayers, as of 2022).

To be eligible, most exchanges simply need to be like-kind, a vague term that does not necessarily mean what it appears to imply. It is possible to exchange an apartment building for vacant land or a ranch for a strip mall, as the rules are quite lenient. Even exchanging one business for another is permissible, but caution is advised as there may be pitfalls.

While the 1031 provision primarily applies to investment and business properties, it can also be used for former primary residences under specific conditions. There are also methods to utilize 1031 exchanges for vacation home swaps, although this loophole is now narrower than before.

Special Rules for Depreciable Property

Particular regulations come into play when exchanging depreciable properties, which may result in a profit referred to as depreciation recapture, taxed as ordinary income. Typically, swapping one building for another can help you evade this recapture. However, exchanging improved land with a building for unimproved land without a building may cause previously claimed depreciation on the building to be recaptured as ordinary income.

Due to these complexities, it is crucial to seek professional assistance when engaging in a 1031 exchange.

Changes to 1031 Rules

Before the Tax Cuts and Jobs Act (TCJA) was enacted in December 2017, 1031 exchanges applied to some personal property exchanges, including franchise licenses, aircraft, and equipment. However, currently, only real property (or real estate) as defined in Section 1031 is eligible.

Nonetheless, the TCJA’s full expensing allowance for certain tangible personal property may help compensate for this alteration in tax law. The TCJA also features a transition rule that allowed a 1031 exchange of qualified personal property in 2018 if the original property was sold or the replacement property was acquired by December 31, 2017.

This transition rule was specific to the taxpayer and did not authorize a reverse 1031 exchange, where the new property is purchased before selling the old one.

1031 Exchange Timelines and Rules

Traditionally, an exchange entails a straightforward swap of one property for another between two parties. However, it is rare to find someone who possesses the precise property you desire and who also wants the exact property you own. Consequently, most exchanges are deferred, three-party, or Starker exchanges (named after the first tax case that permitted them).

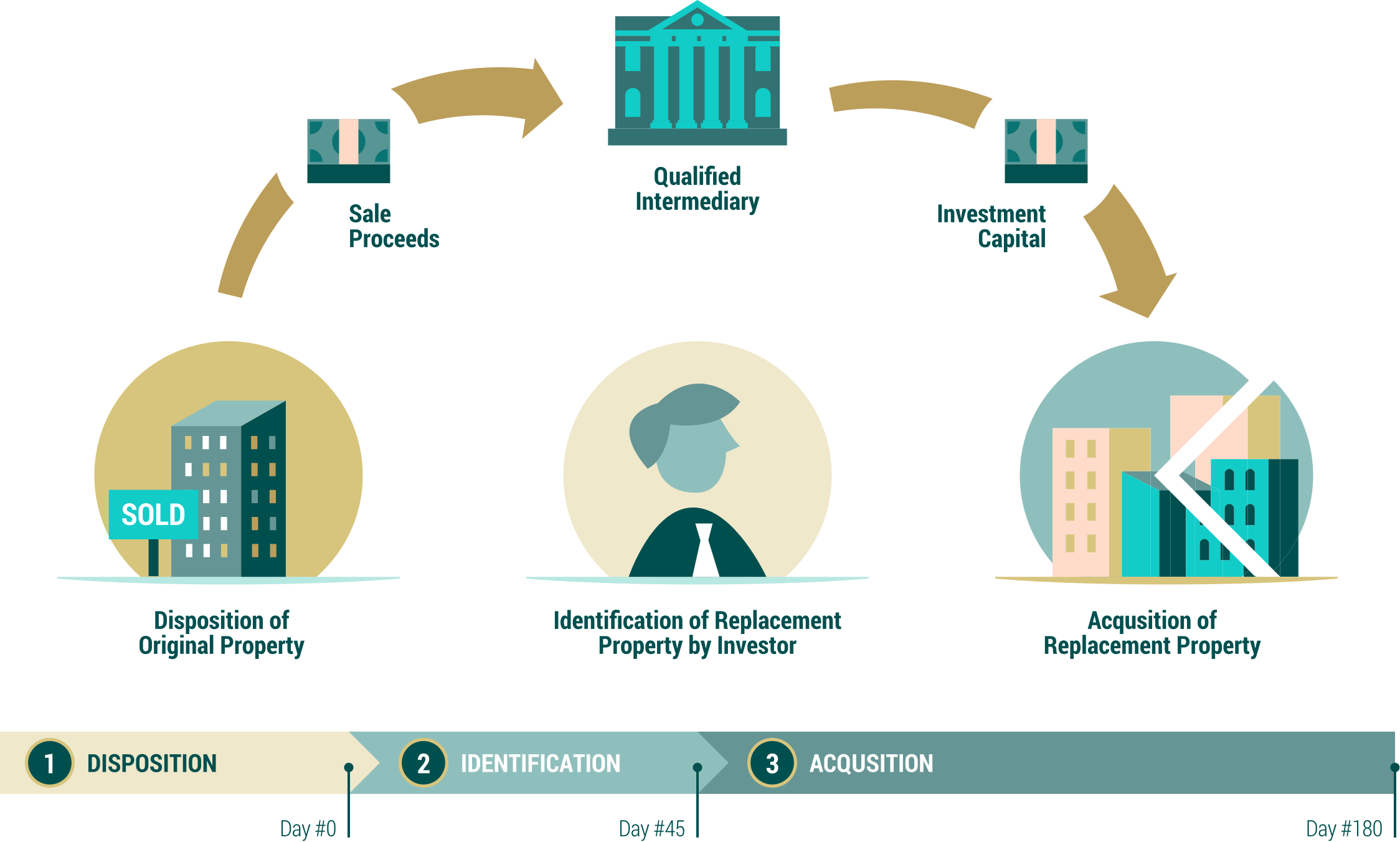

In a delayed exchange, a qualified intermediary (middleman) is required to hold the funds after selling your property and use them to purchase the replacement property on your behalf. This three-party exchange is considered a swap.

It is essential to adhere to two crucial timing rules when engaging in a delayed exchange.

45-Day Rule

The first rule pertains to identifying replacement property. Once your property is sold, the intermediary receives the funds. You must not take possession of the money, or it will invalidate the 1031 treatment. Within 45 days of the sale of your property, you need to specify the desired replacement property in writing to the intermediary.

The IRS allows you to designate up to three properties, provided you ultimately close on one. You may even identify more than three if they meet specific valuation criteria.

180-Day Rule

The second timing rule in a delayed exchange involves closing on the new property, which must occur within 180 days after selling the old one.

Please note that both periods run concurrently, beginning when your property sale closes. For instance, if you designate a replacement property 45 days later, you will have only 135 days left to close on it.

Reverse Exchange

It is also feasible to purchase the replacement property before selling the old one while still qualifying for a 1031 exchange. In this case, the same 45- and 180-day timeframes apply.

To be eligible, you must transfer the new property to an exchange accommodation titleholder, identify a property for exchange within 45 days, and complete the transaction within 180 days from the date the replacement property was acquired.

1031 Exchange Tax Implications: Cash and Debt

If there is any remaining cash after the intermediary procures the replacement property, it will be paid to you at the end of the 180 days. This leftover cash, known as boot, will be taxed as partial sales proceeds from the sale of your property, typically as a capital gain.

A common issue that arises in these transactions is the failure to account for loans. You must take into consideration any mortgage loans or other debts on both the property you are relinquishing and the replacement property. If you do not receive any cashback but your liability decreases, this will also be treated as income, similar to cash.

For example, if you had a $1 million mortgage on the old property and the mortgage on the new property acquired in exchange is only $900,000, you would have a $100,000 gain, which is also considered as boot and subject to taxation.

1031s for Vacation Homes

You may have heard stories of taxpayers using Section 1031 to exchange one vacation home for another, potentially even for a property they plan to retire in, thereby delaying any recognition of gain. Subsequently, they move into the new property, make it their primary residence, and eventually intend to use the $500,000 capital gain exclusion. This exclusion allows a couple to sell their primary residence and shield up to $500,000 in capital gains, provided they have lived there for two out of the past five years.

In 2004, Congress restricted this loophole. Nevertheless, taxpayers can still convert vacation homes into rental properties and perform 1031 exchanges. For instance, you can cease using your beach house, rent it out for six months or a year, and then exchange it for another property. By securing a tenant and conducting business professionally, you likely convert the house into an investment property, which should make your 1031 exchange acceptable.

According to the IRS, merely offering the vacation property for rent without actual tenants would render the property ineligible for a 1031 exchange.

Moving Into a 1031 Swap Residence

If you plan to use the swapped property as your new secondary or primary residence, you cannot move in immediately. In 2008, the IRS established a safe harbor rule, stating it would not contest a replacement property’s qualification as an investment property under Section 1031 if certain conditions were met. To satisfy the safe harbor, during each of the two 12-month periods following the exchange:

-

- You must rent the dwelling to another person for a fair rental price for at least 14 days.

-

- Your personal use of the dwelling cannot exceed 14 days or 10% of the number of days the dwelling is rented at a fair rental price during the 12 months.

Additionally, after successfully exchanging one vacation or investment property for another, you cannot instantly convert the new property into your primary residence and benefit from the $500,000 exclusion.

Before the 2004 law change, an investor could swap one rental property in a 1031 exchange for another, rent the new property for some time, move into it for a few years, and then sell it while taking advantage of the principal residence gain exclusion.

Now, if you acquire a property through a 1031 exchange and later try to sell it as your primary residence, the exclusion will not apply during the five years starting from the date the property was obtained in the 1031 like-kind exchange. In other words, you will have to wait significantly longer to use the principal residence capital gains tax break.

1031s for Estate Planning

One downside of 1031 exchanges is that the tax deferral will ultimately come to an end, resulting in a substantial tax bill. However, there is a workaround.

Tax liabilities cease upon death, so if you pass away without selling the property acquired through a 1031 exchange, your heirs will not be required to pay the deferred tax. They will inherit the property at its stepped-up market value.

This means that a 1031 exchange can be an excellent tool for estate planning.

How to Report 1031 Exchanges to the IRS

To inform the IRS of a 1031 exchange, you must complete and submit Form 8824 with your tax return for the year in which the exchange took place.

The form will require information about the exchanged properties, the identification and transfer dates, any relationship you may have with the other parties involved in the exchange, and the value of the like-kind properties. Additionally, you must disclose the adjusted basis of the relinquished property and any liabilities assumed or released.

It is crucial to accurately fill out the form, as errors could lead the IRS to believe that you have not followed the rules, potentially resulting in a large tax bill and penalties.

The Bottom Line

A 1031 exchange is a tax-deferred strategy that knowledgeable real estate investors can use to build wealth. However, the complexities involved necessitate understanding the rules and seeking professional assistance—even for experienced investors.

Whether you’re looking for property for sale in the Miami area or property for rent, Andrey Rossin Realty makes searching easy.

Frequently Asked Questions

You can use this guide to familiarize yourself with rules, laws, and other important information relating to 1031 exchange properties.

Generally, a principal residence does not qualify for a 1031 exchange since it is not held for investment purposes. However, if you rent it out for a sufficient period and avoid living there, it may become an investment property and potentially qualify for a 1031 exchange.

1031 exchanges apply to real property held for investment purposes. Thus, a typical vacation home will not qualify for a 1031 exchange unless it is rented out and generates income.

It is recommended to hold the replacement property for several years before changing ownership. If you dispose of it quickly, the IRS may assume it was not acquired for investment purposes – the primary requirement for 1031 exchanges.

Kim owns an apartment building worth $2 million, twice what she paid for it seven years ago. Her real estate broker tells her about a larger condominium in a higher-rent area on the market for $2.5 million. By using a 1031 exchange, Kim could sell her apartment building and use the proceeds to help pay for the bigger replacement property without immediate tax liability. She effectively has more money to invest in the new property by deferring capital gains and depreciation recapture taxes.

Depreciation allows real estate investors to pay lower taxes by deducting the costs of a property’s wear and tear over its useful life. When the property is sold, the IRS usually wants to recapture some of those deductions and include them in the total taxable income. A 1031 exchange can help delay this by rolling over the cost basis from the old property to the new one. In other words, your depreciation calculations continue as if you still owned the old property.

Our team stats

Despite well over $10 million in combined sales, however, the team strives to maintain an air of humility and discretion.